LOAN PROCESS AUTOMATION

Close loans faster and grow your business with software specifically designed for securing commercial real estate debt

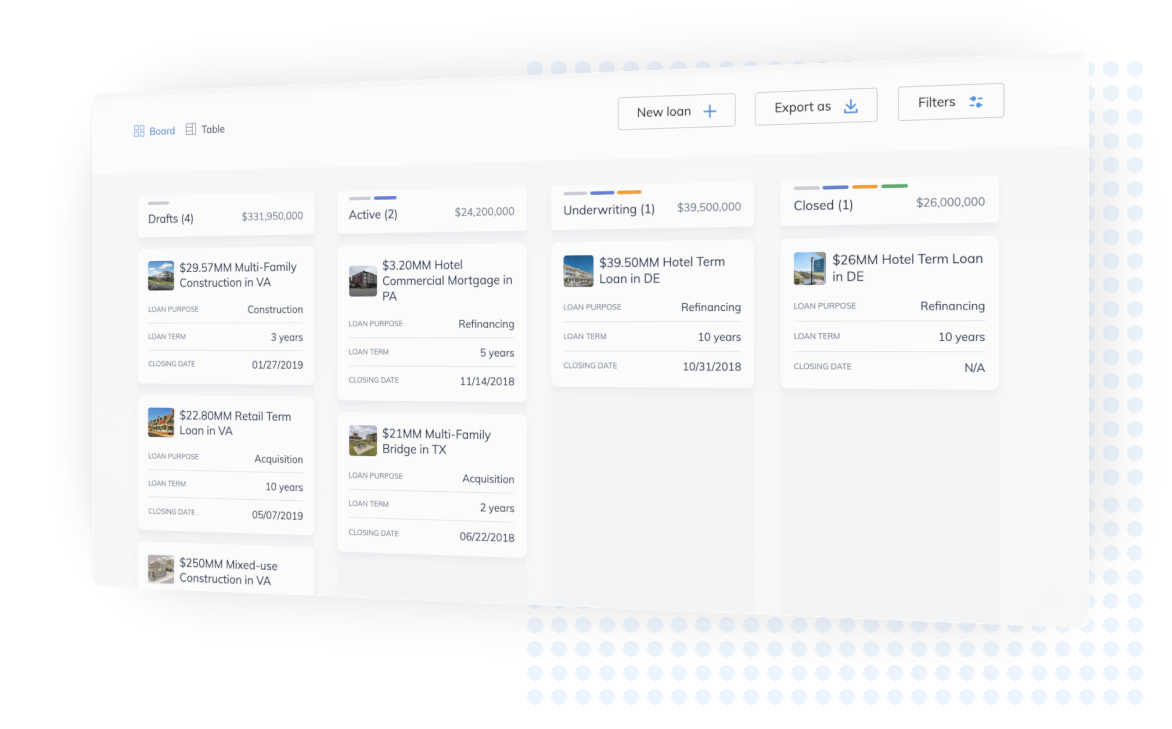

Increase revenue with all the tools you need — in one place — to shorten loan cycles.

Securely create, distribute and track your loan packages (debt memos) through one integrated, streamlined platform. Work with your existing lenders or RealAtom’s network of qualified lenders.

Save time and originate more deals while working less. Engage more lenders using automated workflows.