Raise your hand if you’ve ever had a stressful experience having to rummage through your emails while going on a fact-finding mission in order to find a loan-related document that your borrower or broker has submitted. And while you are frantically looking for documents, or maybe you did not even open the email with documents because it got lost among a flood of other emails, your client took the loan to 5 other lenders. By the time you get to it, the opportunity may be gone. Realizing the pain we decided to build a technology to streamline all points of contact between lenders, brokers, and borrowers; so that each player has a platform to store all loan-related data in one place; thus creating a single source of truth which can be queried for real-time status.

As a true technology company, our aim is to automate and simplify your day-to-day interactions. The first step, we gave your clients an ability to invite you to their private directory on RealAtom. As you know, your clients usually work with you and a few alternative lenders and they usually have all their contacts in Outlook or spreadsheets and they send all their lenders loan information by email. With RealAtom those days are gone. With a two-sided platform, you have your clients on one side, and your clients have you and their other lenders on another side. So everything is organized in one place. When your client invites you to RealAtom, you will be asked to set up your account, and enter your lending criteria. By the way, the days when you have to call or email all your hundred clients to tell them your lending criteria have changed are long gone. Now you can do it in one place and all your clients will get the update. Want to know how, read further. Meanwhile, we do recommend keeping your criteria current. Your clients will use it to send you loans. The more up-to-date your criteria, the more relevant loans you will get to see, the better your “hit ratio”.

Did you know that the average hit ratio for a community bank is about 8%, while it’s 5% for a credit union and 3% for a life insurance company?

Hit ratio = #of funded loans / total # of loan applications seen

I bet you would want to work on more deals that you can actually close, than look at hundreds that can never pass your “face control”, right? So let’s make your gateway as tight as possible, so you can get more viable business in.

Useful tip: If sponsor location or owner-occupied status is a factor in your lending decision, specify sponsor locations and owner-occupied status in your lending criteria on RealAtom.

Working with Loan Requests

Did you know that as a technology company we work off our users’ feedback? As soon as we gave borrowers and brokers a place on the platform to organize their lenders, they started to onboard lenders in bunches. Many of these lenders have quickly realized the convenience of the system – invite clients, have them exchange loan information, share documents, have all transactions all in one place. Those savvy lenders reached out to RealAtom asking why we did not have the same “invite your clients” capabilities for lenders. Different lenders gave us different reasons why they wanted all loan requests in one place. The most common reasons were the lack of a system of records for all incoming loan requests and inefficiency of sharing loan data through emails. As you know, lenders look at hundreds of loans, most of them come either by phone or email, and the majority are rejected by the lenders from the start. Lenders care about their clients and spend days, weeks, months to review or size those requests. What they do not have time to do is to record those requests in the internal systems. At the end of the day, the hard-working loan originators can not even report to their management on all deals they have worked on. As for loan data and documents being shared in emails, let’s not even go there. We all know it is a hassle.

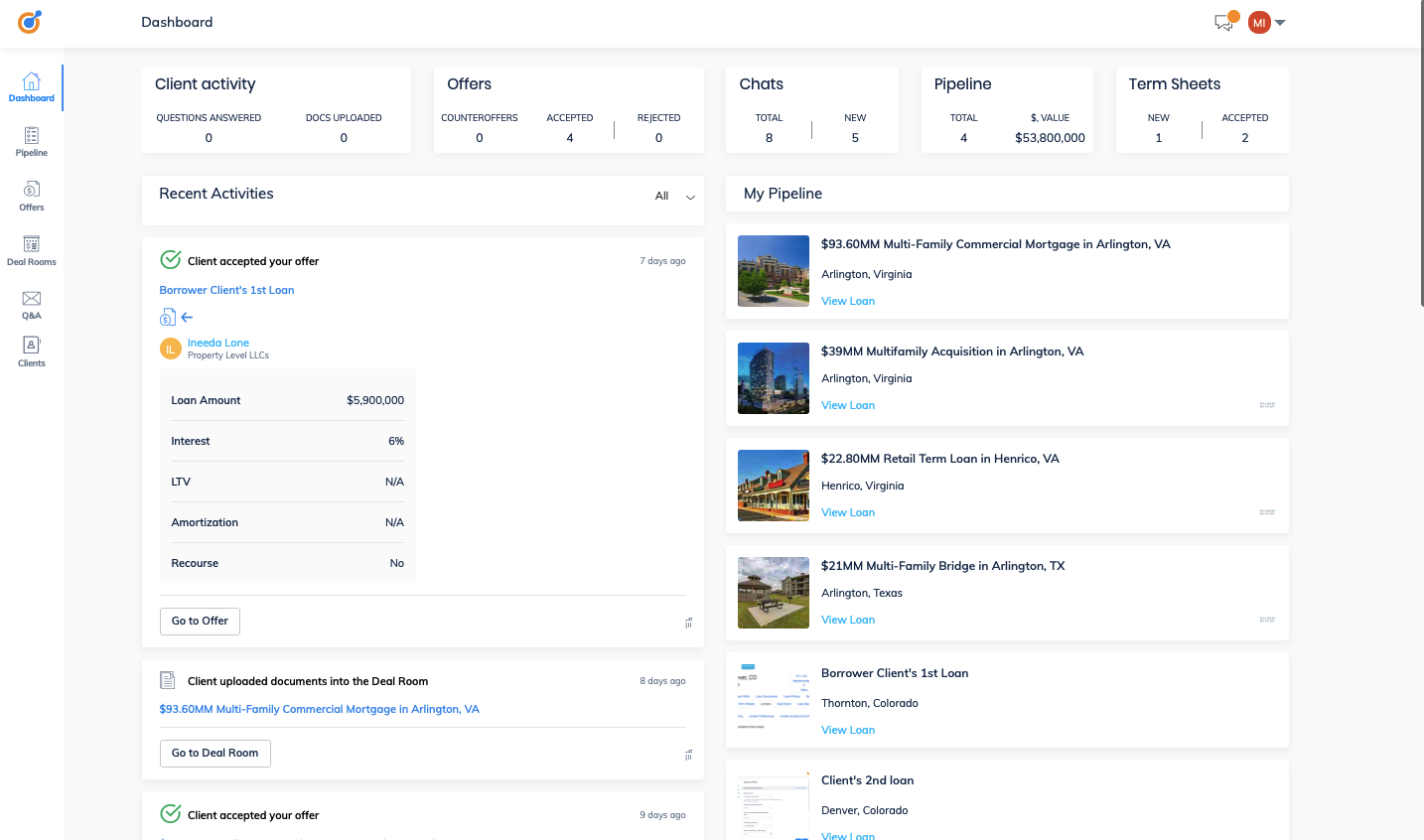

Guess what, at RealAtom, we do listen and attend to our users’ pains! Now lenders can also use RealAtom as a front-end loan intake portal to have all their loan requests organized. It is soooo easy. Set up your account, add your lending criteria, invite your clients. Sit back and keep an eye out on the email and text-message notifications as your borrowers and brokers send you loan requests. Conveniently review the requests on your dashboard where you can get a quick glance at your entire lending pipeline and associated action items.

What are other benefits of getting loan requests through RealAtom other than a system of record for all requests you work on, the efficiency of loan data sharing and consequential increased hit rate?

RealAtom is built by industry experts and technology visionaries specifically for the CRE lending industry. Our goal is to make the loan info intake as easy and structured as possible. We have analyzed tons of loan data and interviewed hundreds of lenders to develop a series of dynamic loan application screens that adjust to loan type, property type, the purpose of the loan, among other factors. As a result, you, as a lender receive a structured, easy-to-read loan memo with a set of attached documents. It’s up to your clients how much information and documents they want to share in the early stage. The track record of every request will stay in your proprietary portal at RealAtom for as long as you care.

These loan requests are filled out by clients via a self-guided intelligent loan application. Clients save hours when sharing their applications with you! Be prepared to see some very detailed requests, and some that may be just the initial summaries. And it’s ok, because we have tools that allow you to request additional information, request documents and ask questions. The best part, unlike emails, all of your requests to clients are tracked and organized in your own dashboard. No more looking for emails and seeing where you are in the transaction. But more on that later.

Meanwhile, take a look at a sample Loan Request next and let’s talk about tools that help you to stay on track with each and every transaction you deal with.

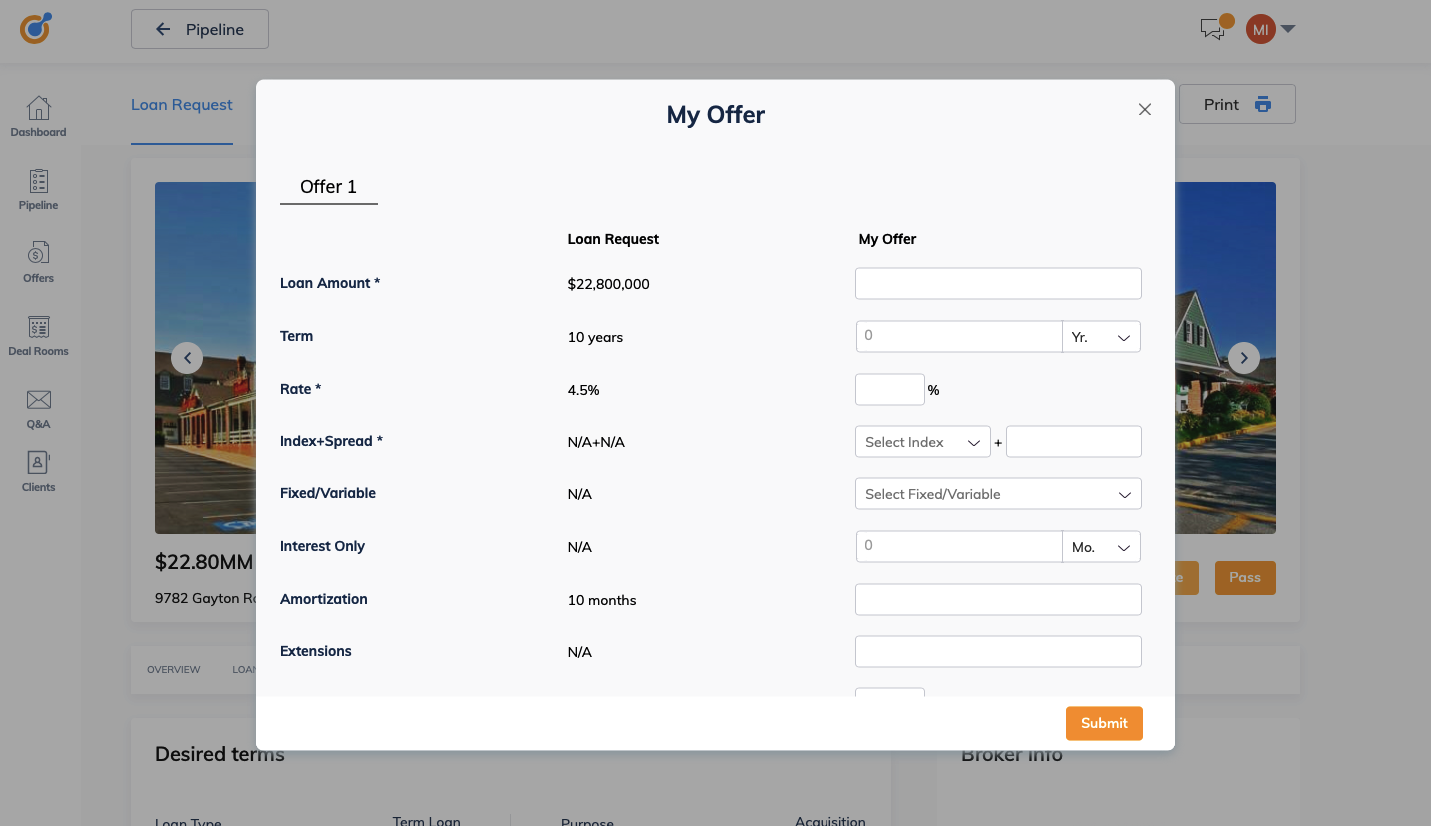

Sizing the loan

Effortlessly provide a detailed soft quote to your clients. The platform will notify your client of the quote and place it on their dashboard. Clients can then negotiate with you all within the same tool, maintaining the history of your communication and negotiation.

Once your quote is accepted, you can issue a term sheet or an LOI and attach it to the loan request. Have the client upload a wet signature for your review; all while notifications are flowing back and forth between you and your clients.

Deal Room to set up your underwriting and closing checklists

To speed up due diligence and closing processes you and your client can use our built-in communication and document-sharing tools. You can set up multiple checklists per deal to accommodate your underwriter, closer or legal document collection. The best part, our deal room is more than just a document storage. The entire tool is interactive! You can review documents in the browser, and mark them as accepted or reject the documents that have incorrect information while letting your client know why you are doing so. Two-way chat allows you to message your client in real-time with specific requests for any additional documents or clarifications.

Read More about DealRooms here

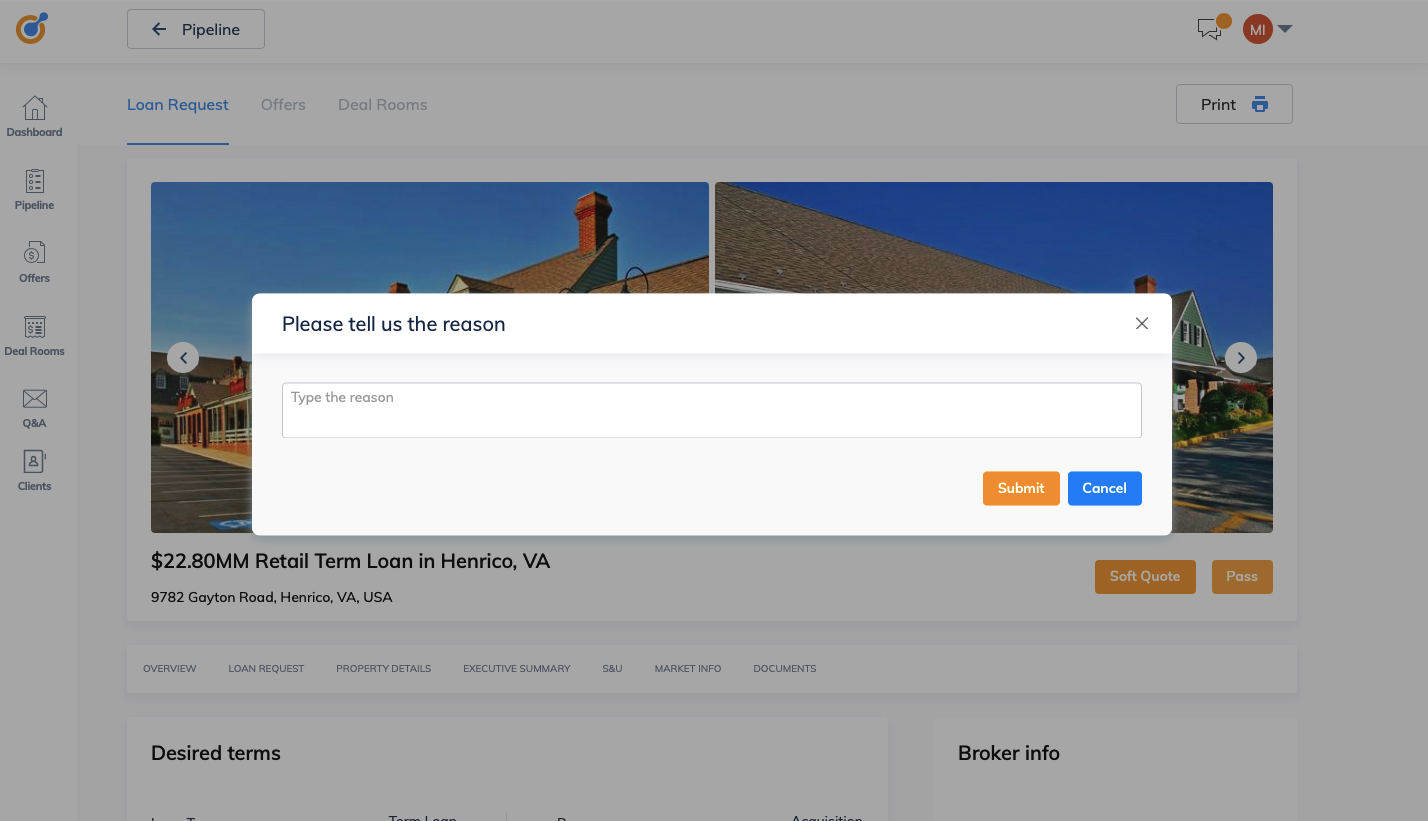

What if the loan request is not a fit?

It’s possible that your clients will send you loan packages that are outside your lending criteria and that’s ok. You have a simple way to pass on a loan request by providing a reason. Once passed, your client will get notified of your decision. There is a record created on your and their side every time you have passed. Having this information will help your clients adjust what they send you and optimize your pipeline.

Useful tip: To increase customer happiness, when you pass on a loan offer, make a referral to another lender or a broker that you think can help your client get the loan.

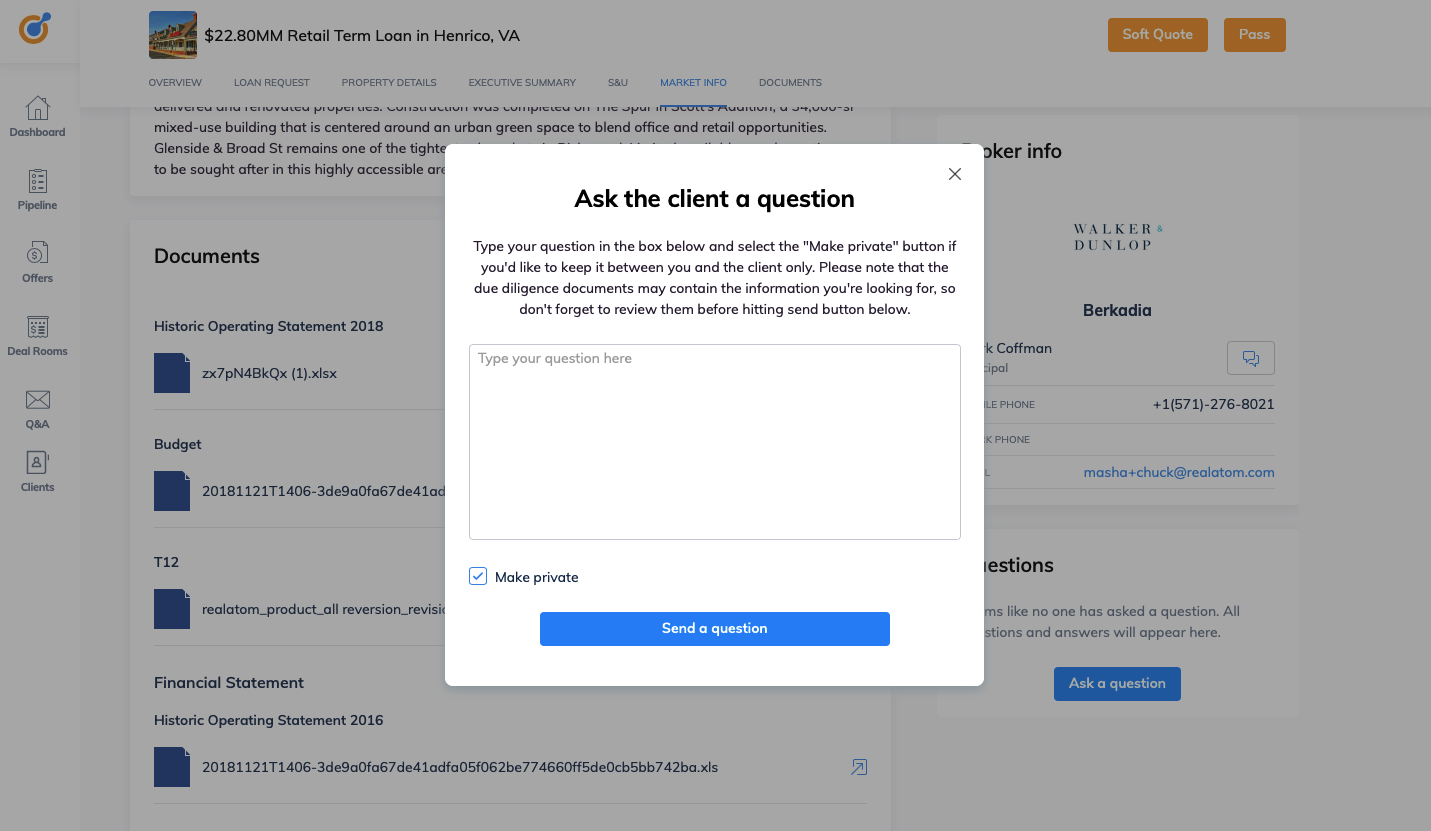

What to do if there is not enough information?

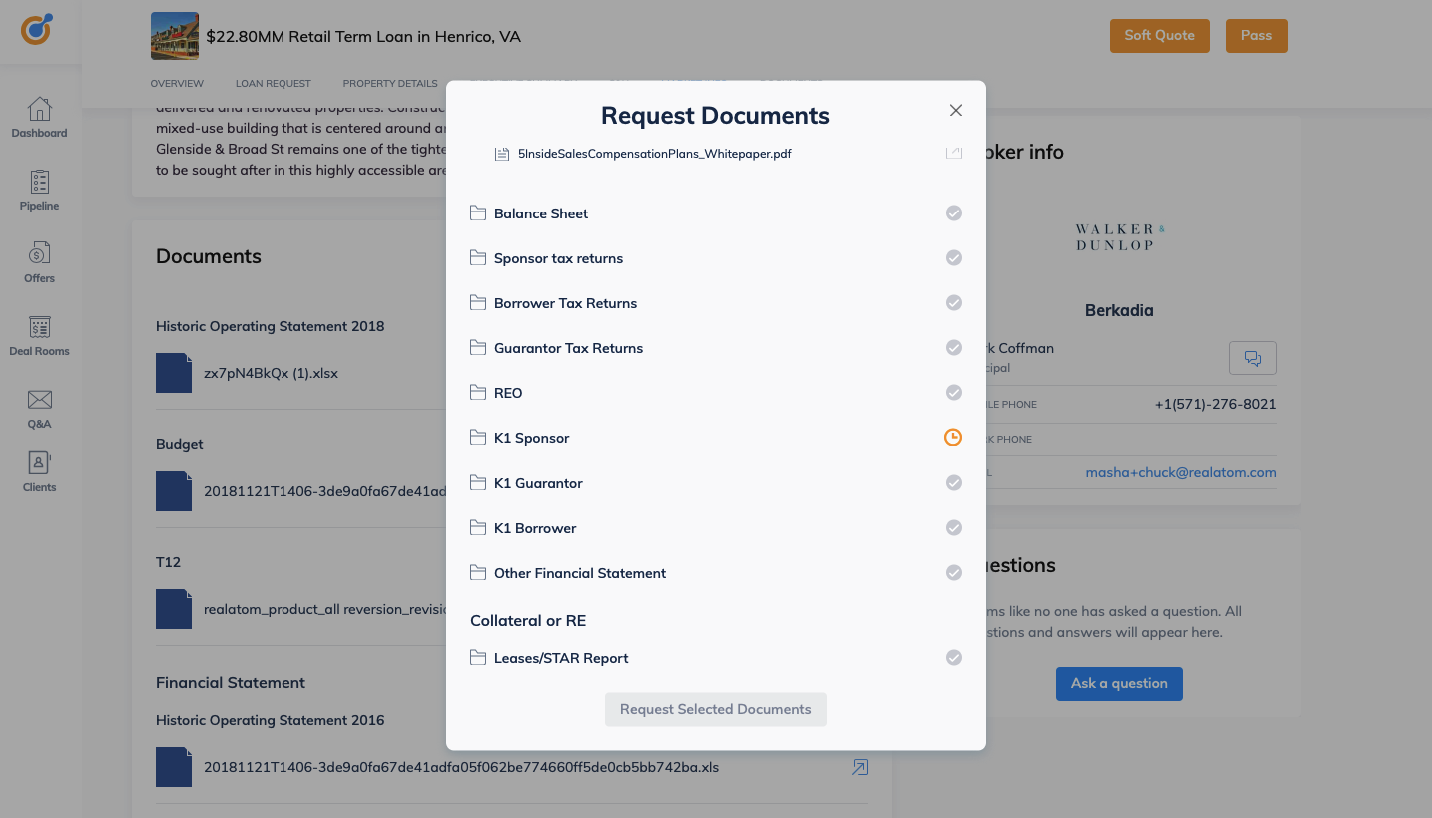

It’s possible that your client did not provide enough information or something is not clear. We offer an easy way for you to ask questions and request documents.

To ask a question, simply click “Ask a question button” and type in your inquiry. When answered you will get a notification on your dashboard and in your email.

To request documents click “Request documents”. Here you can select from a predefined list of documents, or you can add your own request. Clients are notified of what is needed via email and on their dashboard. When they submit these documents, you are also notified via your email and your dashboard. What’s more, anytime a client updates their loan request, you get notified of that as well – you can even see what’s changed in the package and when.

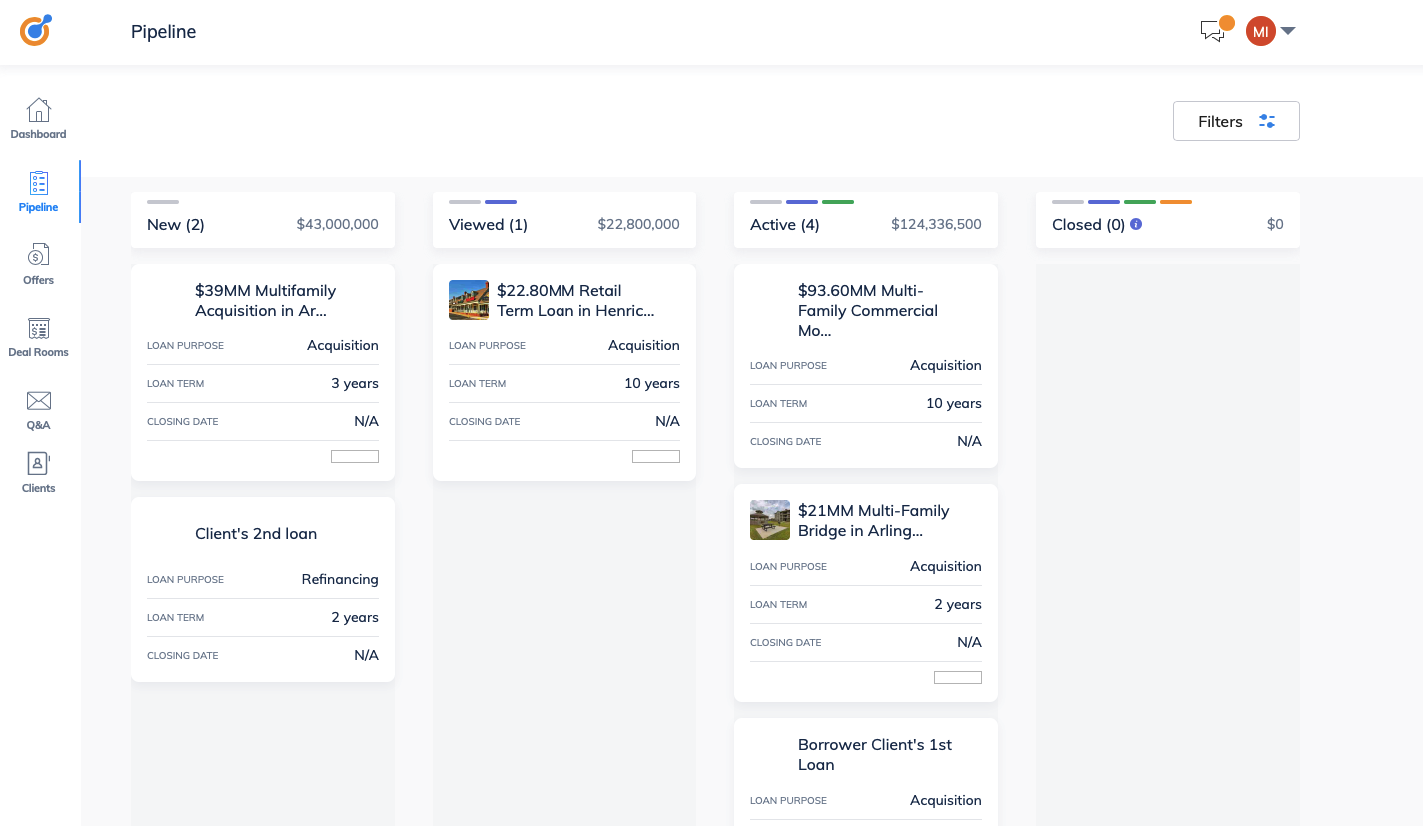

Dashboard and Reporting

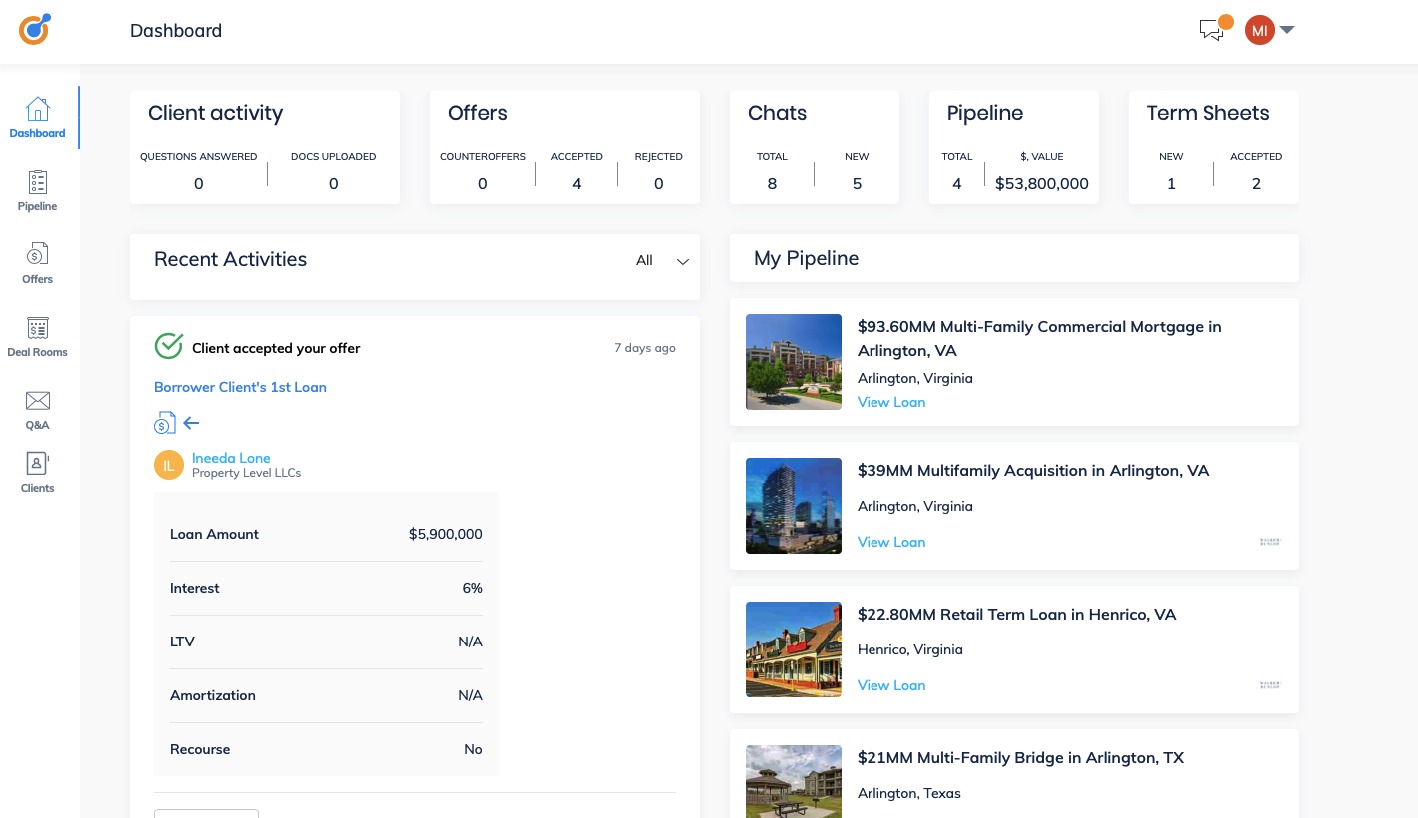

Stay in the know and monitor every loan request from the moment it enters your pipeline. Review new loans and respond to active loans, look at deals side by side from the priority standpoint. Estimate what will close and what is far from closing.

Command-center dashboard is here to help you stay on top of all the to-dos. Receive notifications when your attention is needed to review deal documents, counteroffer or a signed term sheet, approve or reject documents to keep the financing process moving.

The purpose of the platform is to make your work, as a CRE lender, easy. We are here for you to listen and attend to your pains. If you’re ready to review your loan portfolio performance, log in to your account and get started. Or if you’re new to RealAtom, request a demo and see which tools are the best fit for you.

;)