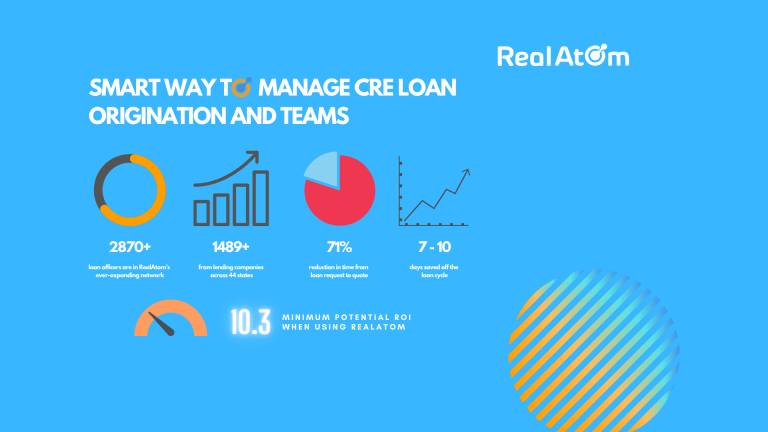

Lender directory in the cloud: Your relationship lenders managed in a collaboration hub. Unprecedented analytics on lender engagement and the financing process.

From the Rolodexes of yesterday to the ever-expanding Excel spreadsheets of today, lender directories are often unorganized, inefficient, and rarely updated. But not anymore. With RealAtom’s cloud-based platform, the future of managing lender relationships doesn’t have to repeat the past.

With our cloud-based lender directory, you’ll find real-time analytics on lender engagement in your own private dashboard. No need to spend hours calling each lender one by one and ask if they can finance your CRE project only to find out they’re at capacity for the year. RealAtom’s lender directory includes the most up-to-date information on lender activity and lending preferences.

We are excited to share that RealAtom now has one of the most powerful, out-of-the-box loan marketing tools in CRE lending–one that allows you to create a single loan request and instantly share it with your relationship lenders. (Of course, you can always choose to expand your network by tapping into RealAtom’s pool of matched, pre-qualified lenders as well)

Plus no marketing skills are required.

It’s time to give your financing process a much-needed upgrade. RealAtom now offers a set of tools and analytics to help optimize all your loan activity and communications, whether it’s in the early Q&A stage, or deeper into term sheet negotiation or underwriting stage.

Is your current financing process inefficient?

The CRE industry is infamous for being at the tail end of innovation. Most commercial real estate lending activities are still done largely offline and behind closed doors where transparency is an afterthought. Many of us are used to expecting long timelines and a lot of complexity, especially when we haven’t established a relationship with the financer. What about the lenders we already know? We assume that our business is unique and lender relationships are strong. After all, we spent a lot of time golfing together. Despite the good times that we have had with our relationship lenders at the driving range, how confident are you about their terms relative to the market? How do I know that my community bank will work hard for my loan? How do I quickly figure out who is interested in financing my project? Currently, the offline, manual loan submission process is fraught with shortcomings.

Consider these 3 common problems with an offline process:

1. Calling all potential lenders one by one takes a lot of time.

Let’s say you have your list of 120 relationship lenders. Even if each call only takes 3 minutes, calling all 120 will take you 6 hours! You have the additional challenge of managing missed calls, voicemails, and follow up requests. If you have a CRM like Salesforce, or Hubspot you can track the calls, but few individuals or organizations have these tools. Even if you do, you have to get through to everyone, which is a daunting task.

2. Sending your debt memo to multiple lenders is a pain.

Let’s assume you narrowed down your list to 10 tier 1 lenders that you think will be interested in financing your property. You will need to send and track 10 emails and 10 separate conversations with these lenders. Now you need to manage document requests, quotes, and negotiations with each lender. How many emails would it take to work on a single transaction? We have seen as many as 1,879 emails exchanged before closing a multifamily refinance deal in Washington, DC.

3. Finding an interested lender is complicated and time-consuming

Now that you’ve made your calls and sent your emails, you have to track who is interested. Back to the magic spreadsheet, now to make sense of all your notes from the calls and enter every quote into a quote matrix. All this time spent when you could be thinking about your next deal or on the golf course. And, to think, your real work hasn’t even begun…

If you’ve experienced any of these headaches — and we know these aren’t the only ones — it’s time to take your lender management process online. The existing offline process simply can’t scale with your business, doesn’t provide you with all the data, nor is it efficient enough to help you run your business smoothly. That’s why RealAtom creates tech tools to fix the commercial real estate lending process, with online lender management being one of them.

Managing Lender Relationships on RealAtom

RealAtom captures everything about your relationship lenders online to give you qualitative insights on the entire loan financing process.

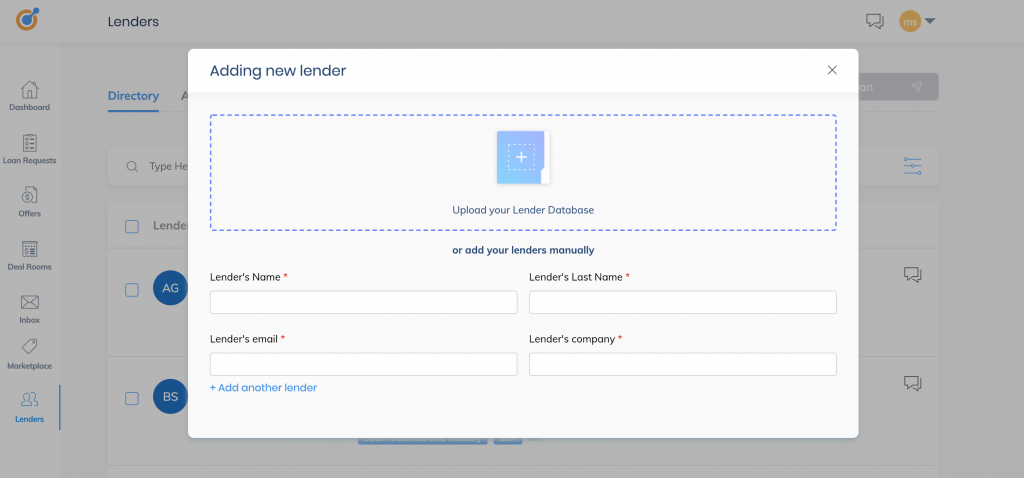

Adding Lenders to Directory

You can add new lenders to the directory by either uploading a .csv file with the lender’s name, email address, and company name. But don’t worry; the lenders added to your directory will only be notified when you invite them to a loan request. You remain in control of your lender directory; RealAtom simply helps make it easier for you to manage.

Inviting Lenders to Review Your Loan Requests

Use a filter or a search to select which lenders you want to invite to your loan request. If you just want to send it to all the lenders, you can select them all as well. Once you have selected your list of lenders, click “Invite to loan” button. Clicking this button fires off an email to your selected contacts with information about the project, a picture of the property, and a link to view the loan request on the marketplace. An added benefit is relationship lenders can participate in up to three loan requests for free, so they have plenty of opportunities to benefit from the full RealAtom experience right away with zero commitment.

In addition to inviting relationship lenders to your loan, you can also invite RealAtom’s pool of direct lenders whose lending parameters match your requested terms. This allows you to start developing relationships with new lenders within our network as well. Again, you remain in control of the lenders that are notified of your loan request.

When lenders take action on your loan, you will receive notifications via email, text message, or push message depending on your notification settings. We generally see soft quotes from interested lenders within the first 24-48 hours after notification. You can also expect to see questions and document requests come in the door even sooner.

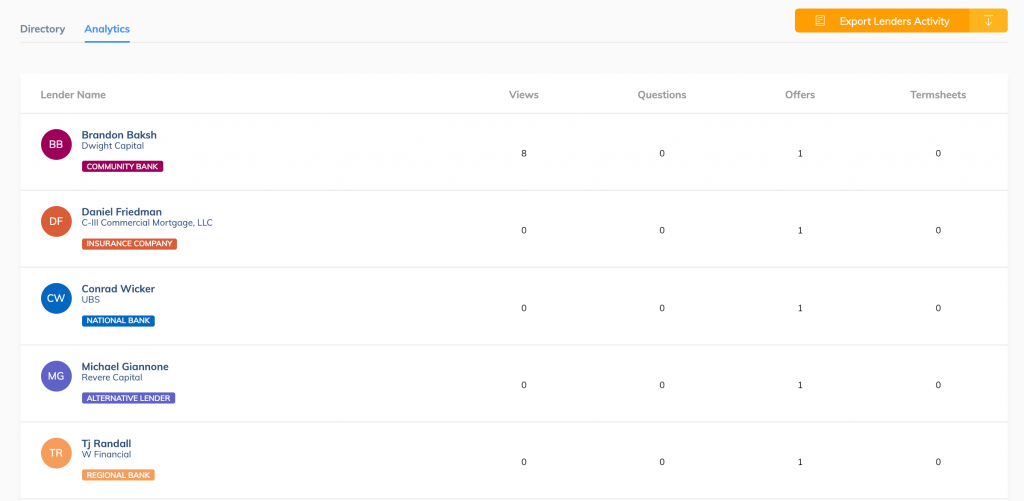

Reviewing Activity Analytics

Don’t forget to look at your lender directory analytics to assess lender interest. Here you will see counts for all the questions, soft quotes, and term-sheets that these lenders have issued. This way you are always in the know on your most active and loyal relationships, or identify new lender relationships that express interest in your requests.

Exporting Lender Activity

Exporting lender activity is not only easy but also useful. We are big believers in giving you access to all the useful data for your loan requests. Lender activity includes: questions, document requests, offers (or soft quotes) and term sheets.

Chatting with Lenders

Initiating a direct chat with lenders to vet your deal has never been easier. Review how chat works, and streamline your entire loan process.

If you’re eager to give lender directory a try, log in to your account and get started. Or if you’re new to RealAtom, start your free trial and begin engaging your lenders directly.

;)