What if you could tell where in the loan process the most lenders drop off or who your most engaged lenders are over a period of time? We always need to have precise information, but during uncertain market conditions, it is especially critical to know where the market actually is. And we need that information as close to real-time as possible.

Why is lender engagement analytics so important?

If you are in a business where your job is to secure commercial real estate debt financing, the level of lenders’ engagement in your transactions is highly correlated with your business’s overall profitability. Lender attention is a finite resource. Highly engaged lenders are more likely to fund the loan. But how do you always know that your target lenders do pay attention to your loan request? We all trust the qualitative method of sending emails and talking to a handful of lenders. Yet we still have to contact each and every lender separately, sometimes several times to make sure that they’ve seen the email with the loan. And what if the lender that has not seen that darn email is the best lender for the loan? We’ve decided to convert all these questions into answers by building you a lender management funnel report for each loan in your pipeline.

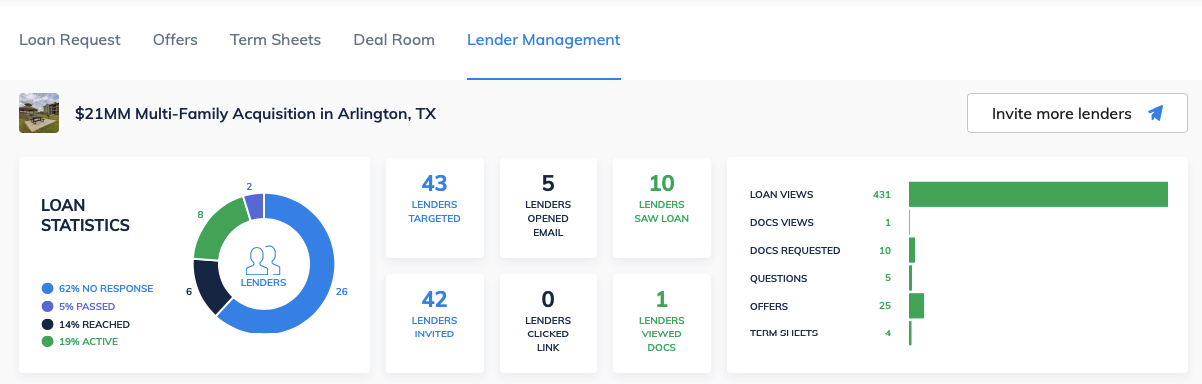

A lender management funnel is a set of steps that a lender takes that leads to a term sheet. When you use RealAtom to send loan requests to your lenders, you gain a true analytics machine that digs deep into lender behavior and can tell you how well your loan request is performing with all of your target lenders. It also works with the lenders on the RealAtom marketplace. With our new lender’s activity analytics module you would not need a degree in data management to be able to track how lenders move through the funnel.

Let’s say we want to use funnel analytics to figure out how your loans are performing with the lenders. At the top of the funnel, we see the total number of targeted lenders (first step). A much smaller number of lenders will complete all the consecutive steps to get to a term sheet. Funnel analysis tells you where you lose lenders along the way and what prevents them from getting to a term sheet.

Analyzing loan marketing campaigns just got a lot easier

Funnels are an amazing tool for gaining insights into the lender’s preferences. Thus identifying the best sources of financing for your new deals. Every CRE company would love to use funnel analytics, but only a few have the opportunity, knowledge, and resources to create processes capable of building funnels. In our email-driven industry, it’s hard to get all of the data in one place for every loan request. To do it in real-time is almost impossible and really expensive.

That’s where RealAtom comes in.

Imagine you have a complicated deal to finance. You want to keep your finger on the pulse every day of the process. For that, you do need to know granular information about what your lenders do with your loan. The information that email simply does not give you. You would want to know how many lenders have reviewed your loan request, downloaded documents, have passed on the loan, the reasons why they passed, or how many lenders have quoted the deal. The granular information not only helps you assess lender interest and tell you who may issue a term sheet faster. It also tells you if you need to bring more lenders to the table, what is critical to do earlier than later.

Spending more time acting on insights

First, RealAtom drastically cuts down on the time it takes to market loan requests to lenders. Next, we have given you tools to get in the lender’s heads to figure out what they think of your deals. Last, we’ve empowered you with advanced reporting tools. The reports combine data from different sources such as email and platform activity enabling you to track important conversion metrics. You can generate great-looking reports to share with your team. No spreadsheets, powerpoints, or word documents needed. Lender funnels are available both in the browser and on mobile. Now, you can spend more time reviewing data and taking analytics-driven action and less time copy/pasting information to create reports.

Real-time insights from real-time reports

Clear and concise reporting is always a critical component for a high performing team. You can’t show the value of loan marketing without it, and you can’t improve results if you don’t know what’s working and what is not.

In the past, you probably had to rely heavily on your analysts to copy/paste quotes and questions into an excel spreadsheet, instead of having an organization-wide, all-in-one-spot view of all the lender-related data.

Now, you can pull every data point for every lender whom you have selected for a particular loan request in real-time. This allows you to constantly have an eye on the most important data – lenders engagement in your deals. Now, you can instantly see leading indicators, such as email open counts, number of lenders who saw the preview of the loan or the full package, down-funnel KPIs like document views, questions, quotes, and term sheets.

Easy to read, actionable and predictive

Data doesn’t do much good if you can’t decipher it. With our intuitive reporting, you don’t have to be an analytics guru to use RealAtom lender engagement funnels. Graphs and charts are automatically generated as soon as the loan is sent to lenders and data start pouring in. The charts will continue to get updated as more data is collected.

Overall Loan Statistics – a pie chart makes it easy to see at a glance how well the outreach is working. Here you can see % of lenders reached, % of lenders not reached, % that passed. and % of lenders that are active about the loan.

Overall Loan Statistics – a pie chart makes it easy to see at a glance how well the outreach is working. Here you can see % of lenders reached, % of lenders not reached, % that passed. and % of lenders that are active about the loan.

Top of the funnel metrics – individual metrics around the total number of targeted marketplace lenders, invited relationship lenders, the total number of lenders that opened the email, clicked to see loan preview, saw the full loan package, and viewed loan documents.

Bottom of the funnel metrics – metrics for active lenders who have viewed the full loan package, viewed and downloaded documents, requested documents, asked questions, quoted the deal, and issued a term sheet. The closer to the bottom of the funnel, the smaller the number of lenders getting there. Hence if you are not getting enough viable interest you can always send the loan to more lenders to increase the top of the funnel in order to achieve the ultimate result of financing your deal.

More usage over time = better analytics

As you know, data, worth analyzing, accumulates over time. The longer you use RealAtom the more intel you’ll gather on your lenders and ultimately the market. Lender engagement funnel reports show completion rates for individual loans. Rather than copy/pasting into Excel, direct your energy to add any offline quotes and term sheets to your RealAtom account and encourage all of your lenders to do the same. Before you know it you will build a new habit that’s not only going to make you more productive but give you valuable insights you did not have access to before.

If you have feedback or suggestions for the Lender Management Marketing Funnel, feel free to let us know via chat. Alternatively, you can also reach out to our awesome support team via support@realatom.com. We’re all ears!

;)