If you are in the business of originating commercial real estate loans, you’ve probably used multiple technologies to share and manage loan documents. The most common way is to do it as an email attachment. Then there is Box.com, Dropbox, and even IntraLinks. But none of these are secure enough or industry-specific enough to meet the requirements of sharing CRE loan packages.

That’s why we are incredibly excited to announce our new product – DealRooms. Already available at no extra cost to our subscribers.

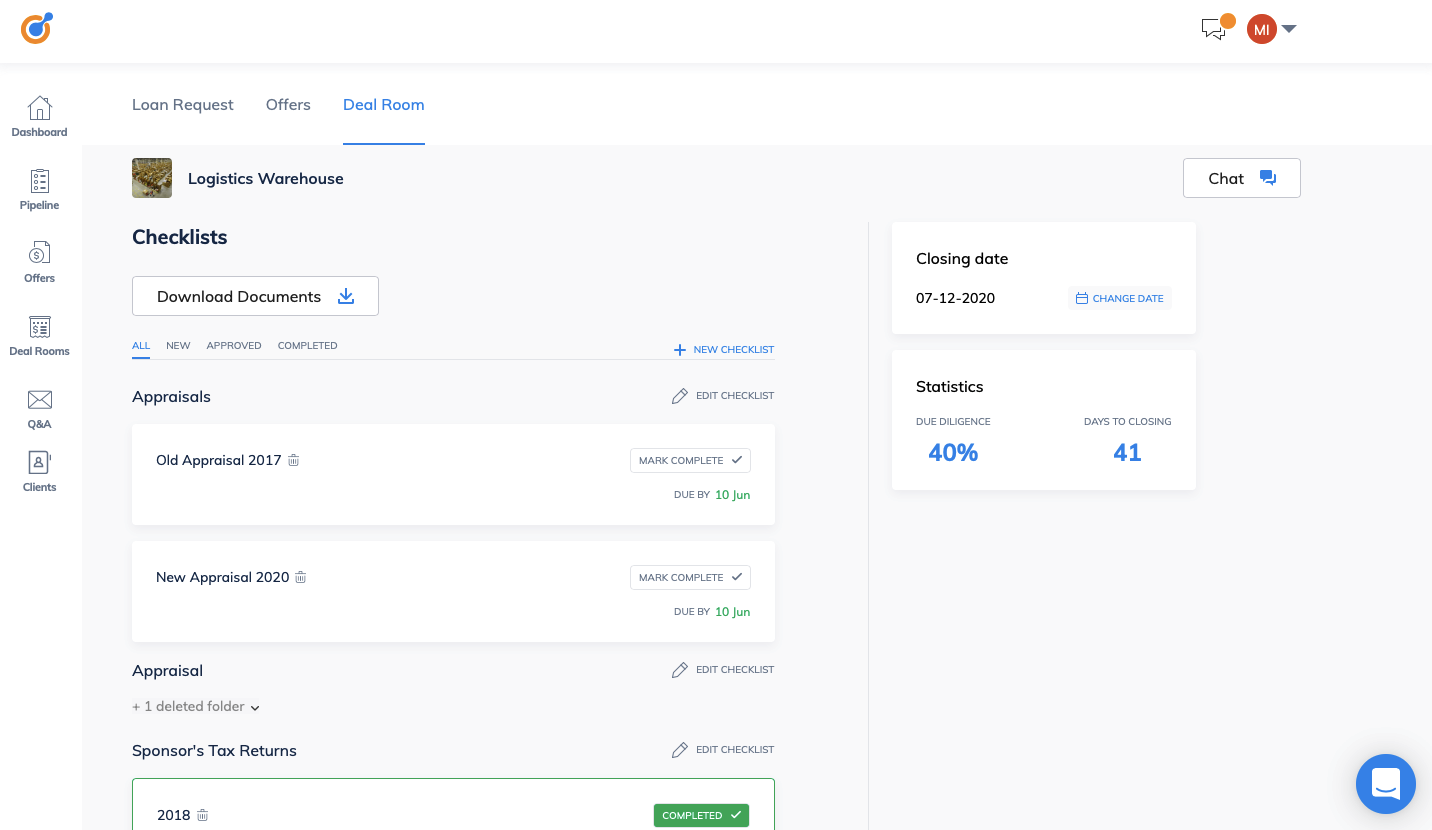

DealRooms empower all parties involved in transactions to efficiently collaborate, share, and store loan documents based on checklists that you as a lender create. All within a secure environment on the RealAtom platform.

Whether you are an industry veteran or a newcomer, running a CRE deal involves creating multiple document checklists and receiving confidential documents from more than one party. RealAtom’s deal room is purpose-built to handle this kind of serious sharing, with ALL the features built to support complex CRE financing transactions. Lender checklists, data storage, diligence tracking, and communication tools, all found in one integrated smart data room.

As a lender—whether you work with a few or few dozen clients—need a convenient, efficient platform to analyze loan applications, ask clarifying questions, request missing documents, submit offers, comment on the attached documents and collaborate on the project with your clients. At the same time, your borrowers or brokers need a robust, technologically advanced data room that will meet the expectations of diverse, demanding partners.

One of the Deal Room’s strongest points is a seamless integration into RealAtom’s robust CRE loan management platform. Data sharing is secure and flexible. You can manage your security settings on your own through extended customization with multi-factor authentication. The Activity Log also stores all file information, for streamlined tracking of clients’ engagement.

Why choose RealAtom’s Virtual Deal Room?

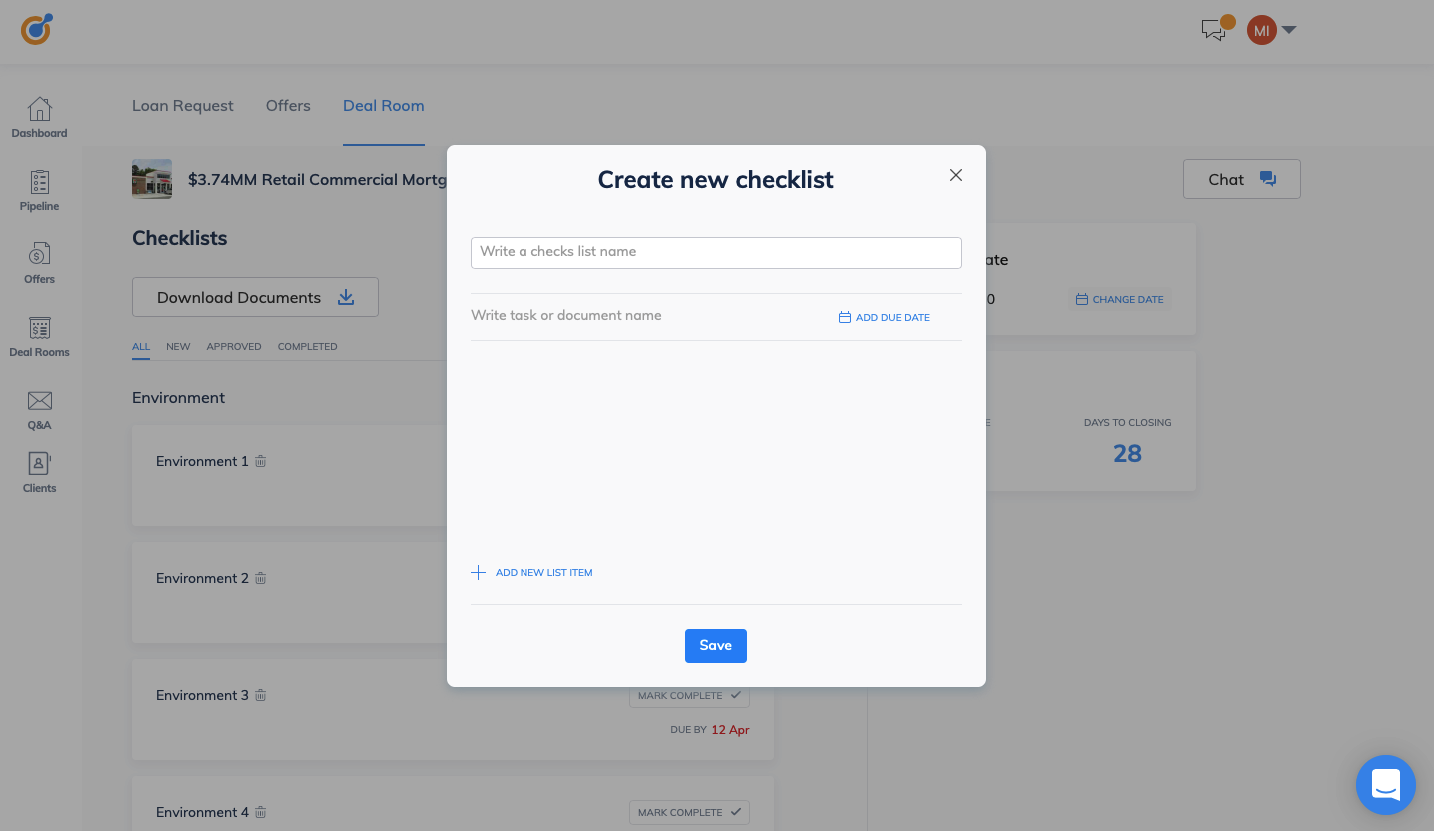

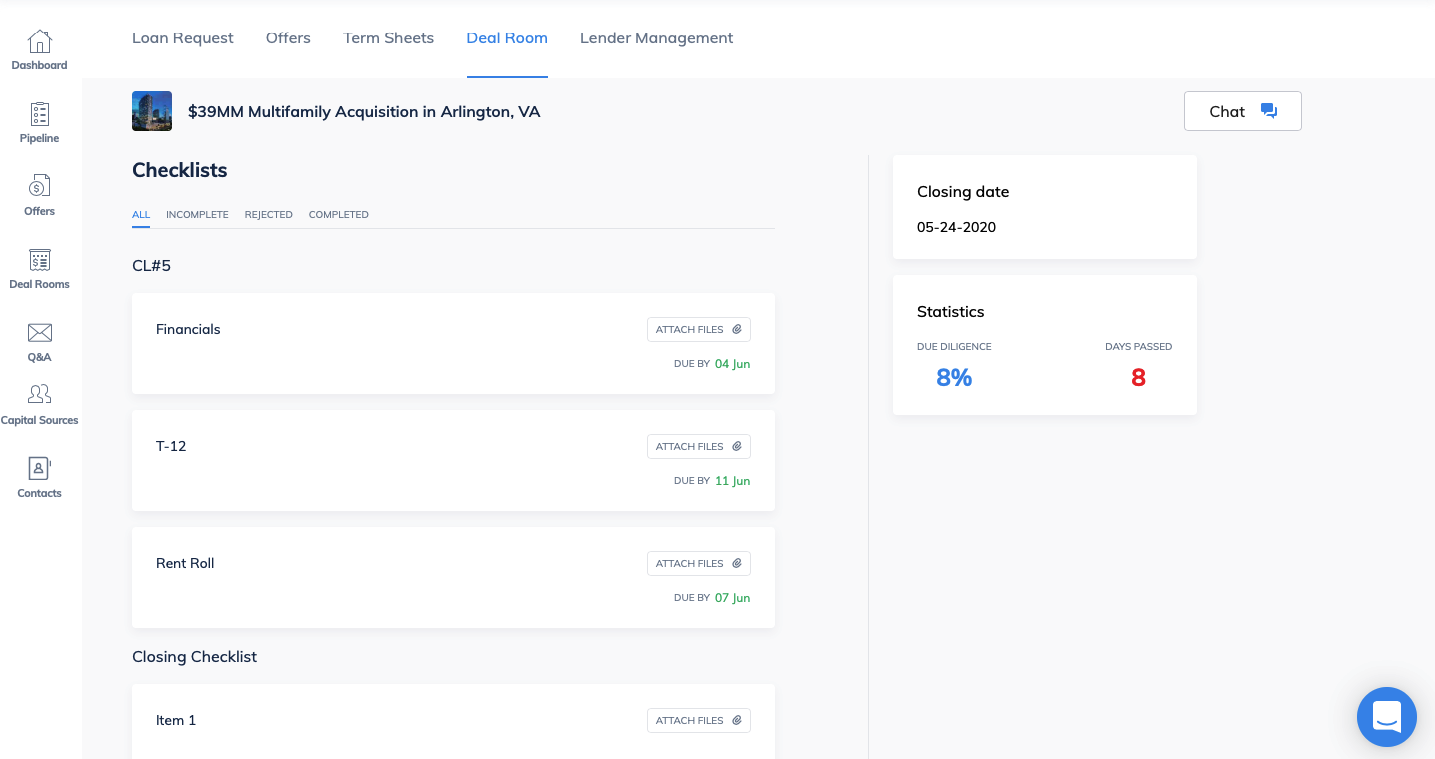

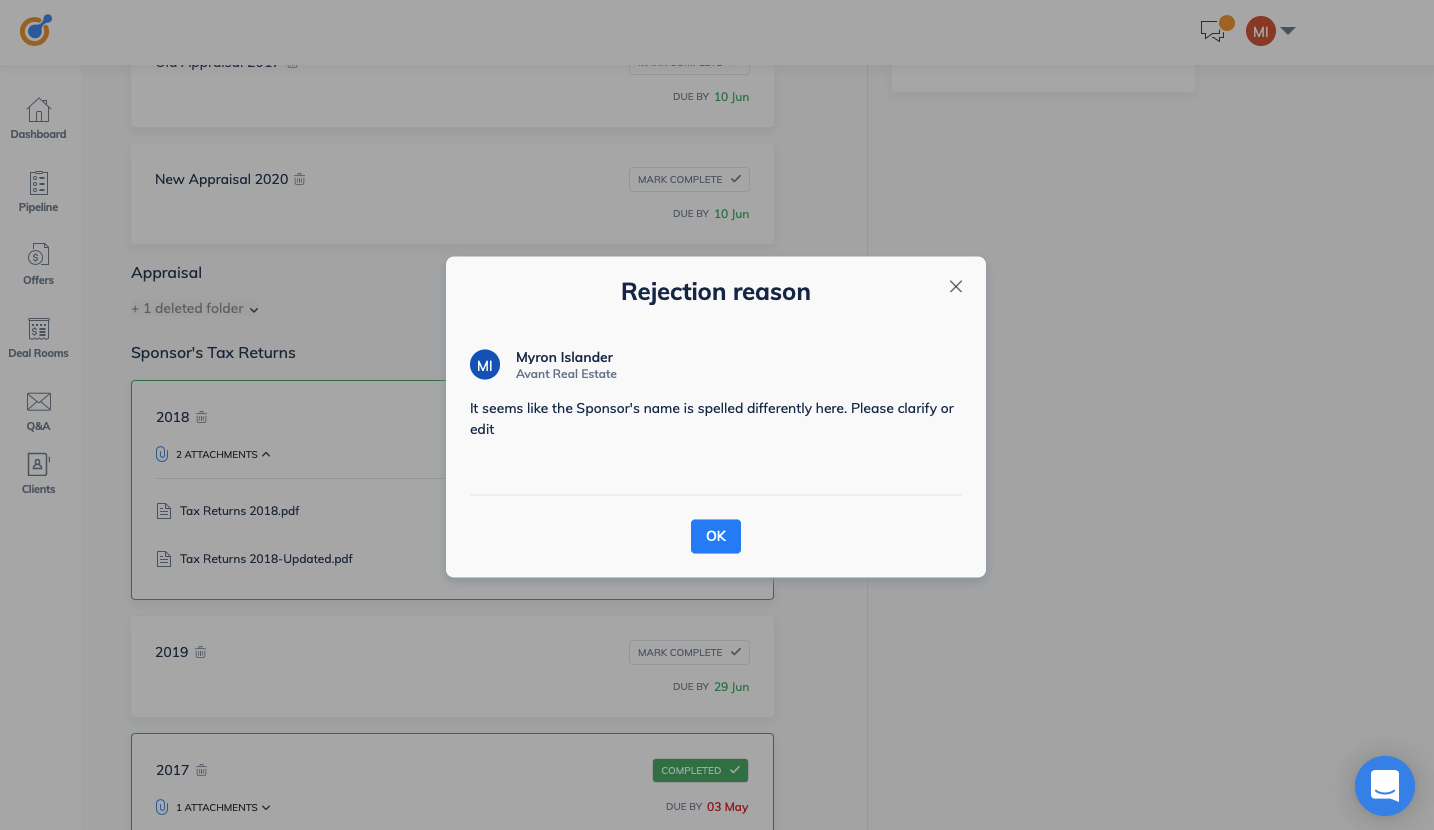

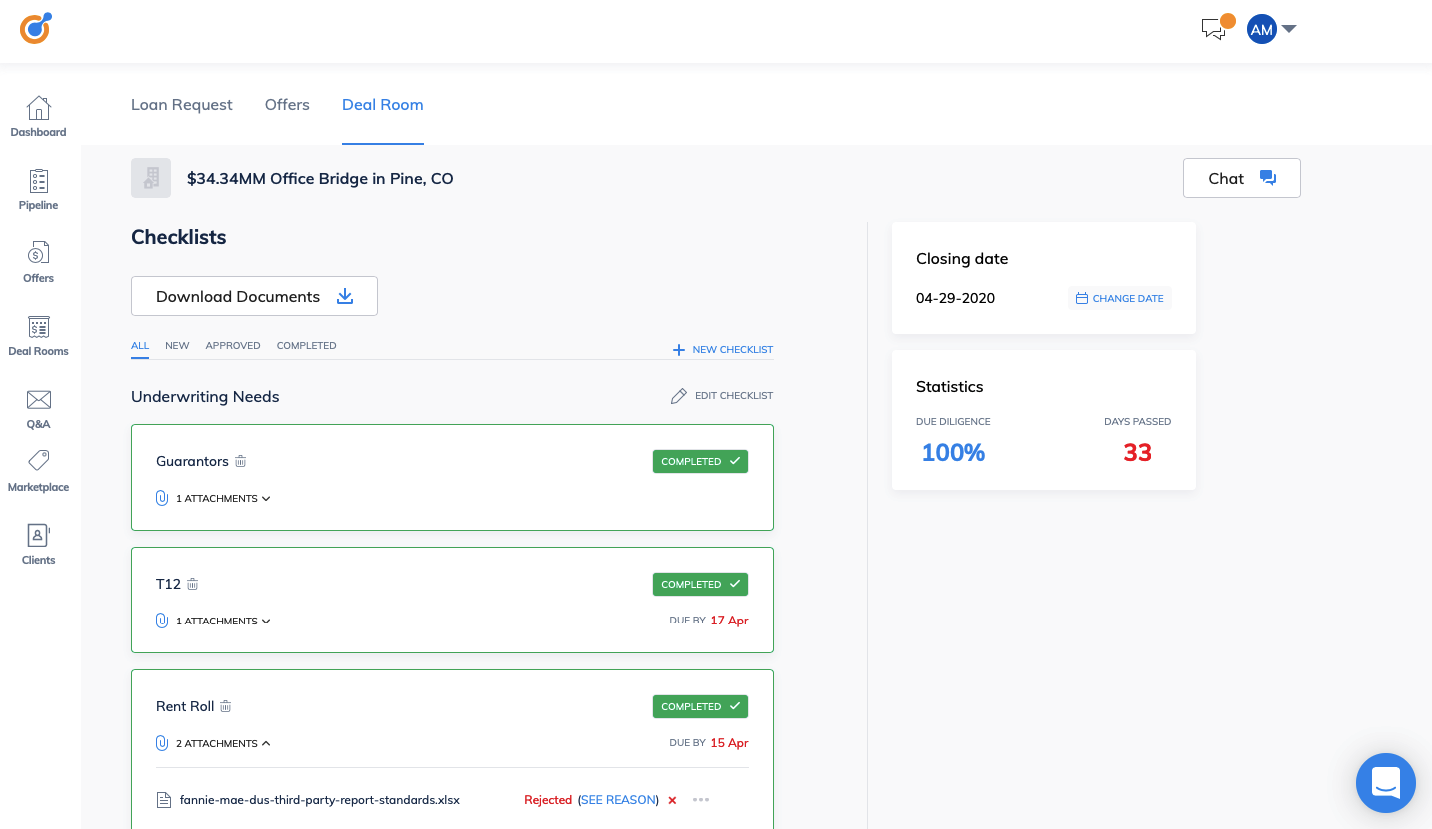

- Actionable Due Diligence Checklists. Origination officers, underwriters, or closers can create multiple checklists with assigned due dates. Once you review the documents submitted by your client, you have an option to mark them as “Complete” when everything is in order. Alternatively, mark “Reject” and provide the reasoning when you need any corrections.

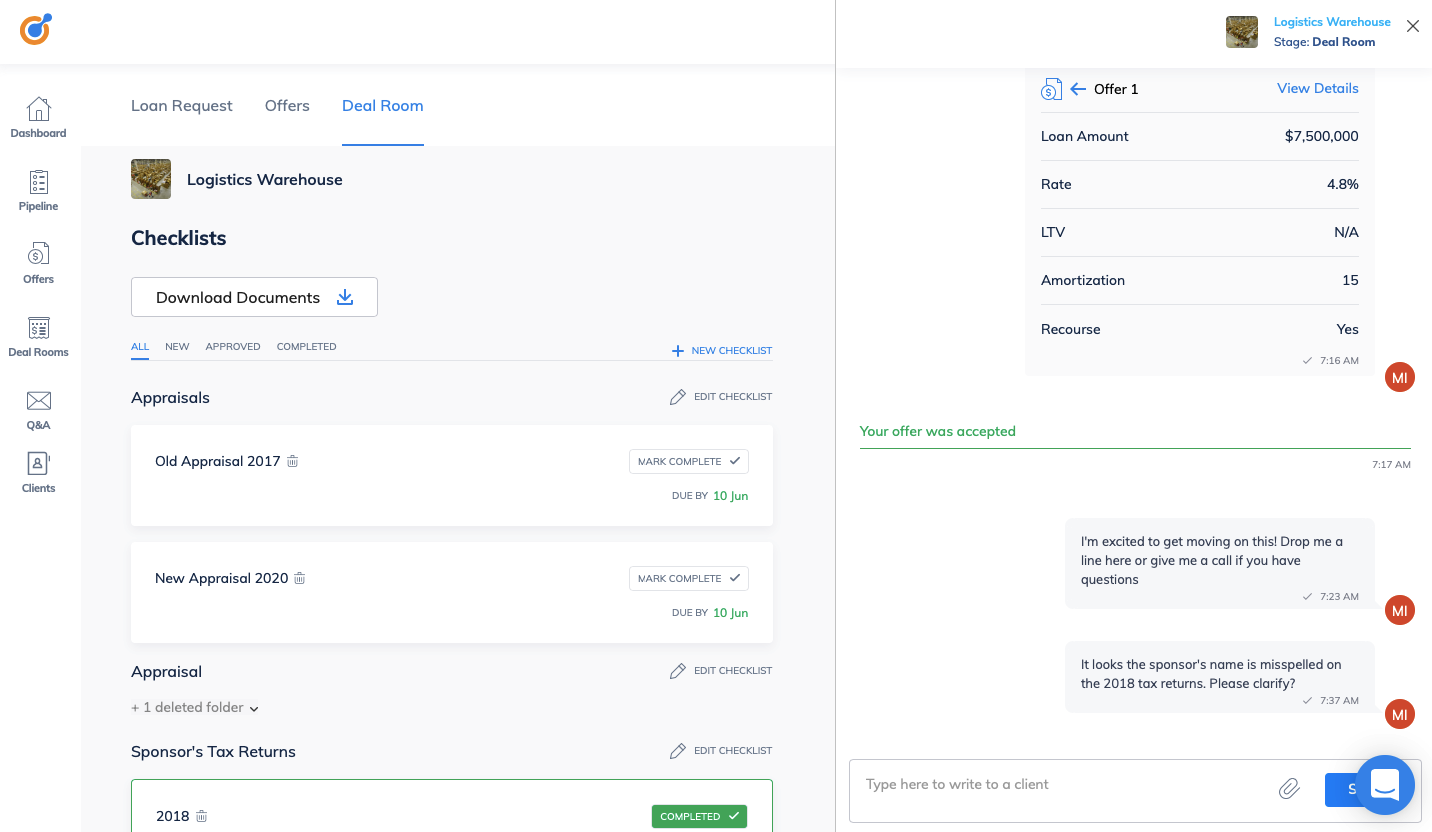

- Real-time notifications. When you create a checklist in relation to any of your transactions, your client gets notified by email and on the client’s dashboard. When your clients submit documents or chat with you, you get notified in the same manner.

- Comprehensive status reporting. With the statistics of percentage completed, how many documents have been submitted vs requested, in the light of the upcoming closing data, you can make data-driven predictions that give you visibility over the progress of your transactions. This enables you to do accurate, fact-based status reporting back to your clients.

- Integrated communication tools. Chat with the clients in real-time to discuss any outstanding documents, ask questions, and communicate just about anything in the context of the deal.

- Accountability. Once the checklist is created, and the documents are coming in, there will be no excuse on both sides of the aisle, about lost checklists or missing documents. Everything submitted, including comments and requests for corrections, will be in one place with full access from the lender side and the client’s side.

How does it work?

- Lender creates one or multiple checklists. Checklist items have due dates assigned to them by the lender.

- Borrower or Broker on another side of the platform gets immediate access to your new deal room.

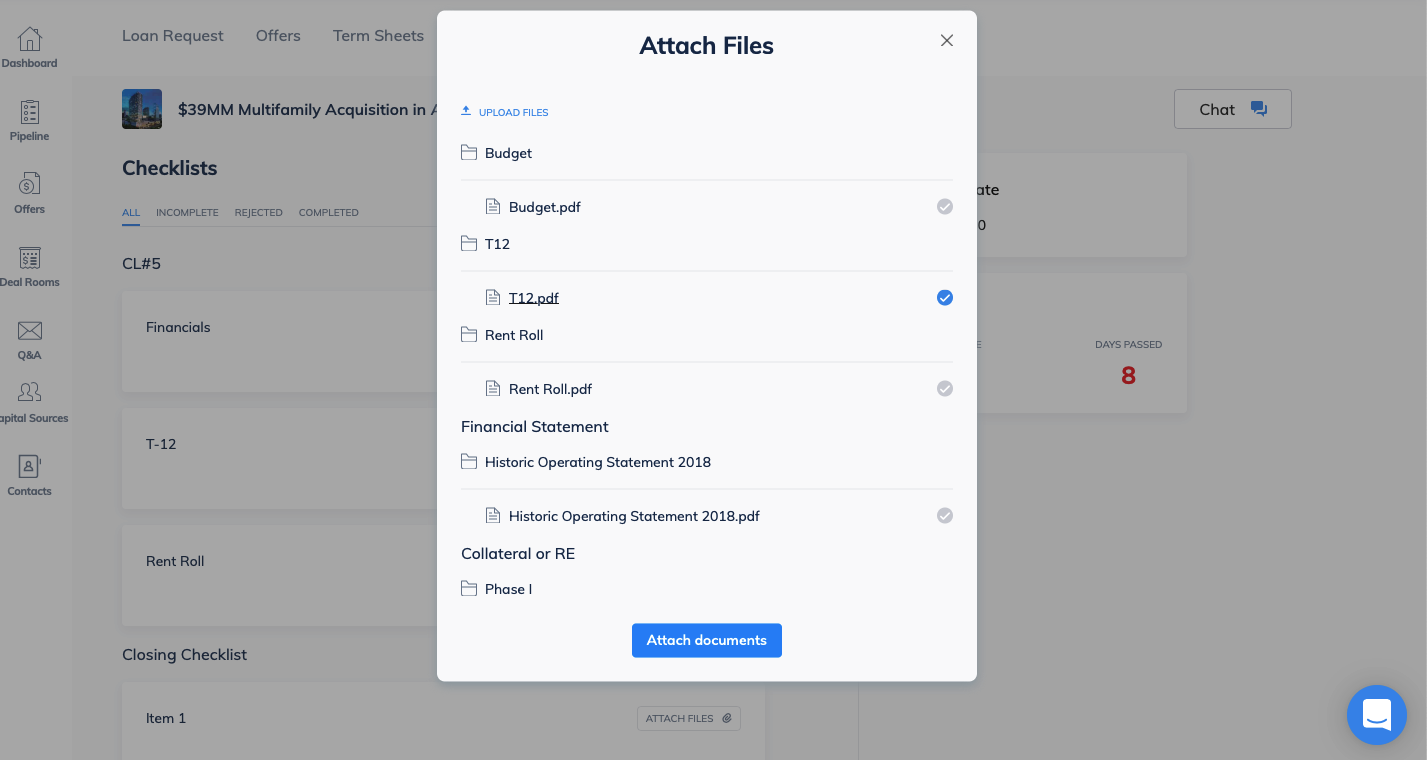

- They can start attaching documents based on each of the checklist items, either from their computer or from loan documents.

- As you receive the uploaded documents, you can review and mark checklist items complete, or mark documents as rejected and provide a reason.

- Clients get very clear notifications on their side of the deal room what documents need to be resubmitted and why. Do comment, so the client knows what you want them to do and can upload accurate information for you.

- Chat with your clients about documents that are being requested.

- When you are satisfied with all the documents submitted, you can mark all the checklist items as complete and deal room status changes to 100%. Congratulations, you did great!

The winning strategy when it comes to optimizing due diligence is pairing interactive checklists created by lenders with secure document sharing. This pairing enables you to track the real-time status of the document submission process, while requesting the documents that matter to you, at the same time prioritizing outreach to and follow-up with clients.

We’d love to hear from you. If you have any questions or feedback about how we could make things better for you and your team, please contact us.

;)