On January 18th, Wall Street Journal published a Pledge by The Platform of Independents, where a group of over 200 companies declared that “Customer Relationship Management (CRM) systems are no longer enough for the digital era”.

The Platform of Independents is led by Segment, a MarTech unicorn (a startup valued over $1Billion) and a group of nine leading independent software companies. The companies united to “liberate data from the limitations of traditional CRM suites and allow businesses to build customized technology stacks that fit their needs”.

RealAtom CTO, Masha Sharma, was the only one representing commercial real estate tech among 200 signatories. And this is no surprise, because in PropTech, and especially in $4.3 billion CRE lending, CRMs are the innovation.

Yet, the existing CRM systems are not built for commercial real estate loans, and they still require extensive manual data entry. Larger companies that have resources to customize the CRM systems to handle the loan process still face a low adoption rate, because users do not like to transfer data from emails and phone calls into the CRM. A staggering 60-70% of the data is being left out. The rest of the data is stuck in the CRM and is not used to create a true 360° view of the customer or a lender.

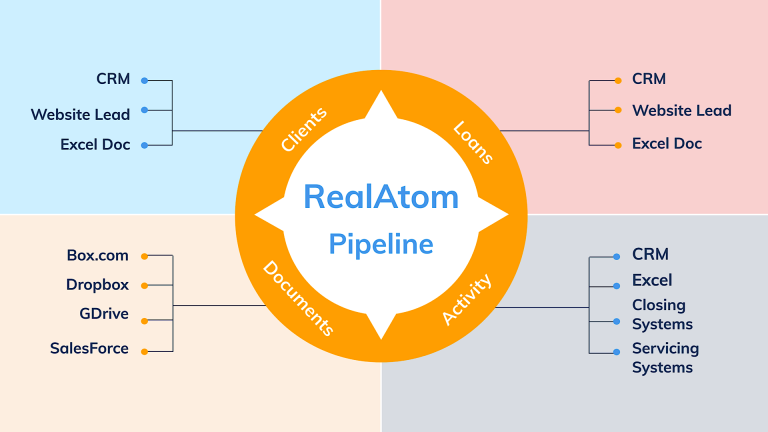

RealAtom has signed the Pledge because very similarly to the other 200 companies we see ourselves as a part of an integrated solution, that in our industry gives the power to capture, analyze, and optimize your mortgage business like never before. As the first SaaS-enabled platform in the commercial real estate lending industry, we optimize loan origination processes by putting lenders and brokers on the same platform through universal & shared loan intake technology. We seamlessly integrate with the existing systems, helping tie everything together, allowing every bit of loan data to safely pass from brokers to lenders and in reverse using secure APIs.

When capital markets, teams, or lending organizations include RealAtom into their capital stack, then all loan applications sent by brokers or received by lenders are automatically recorded into clients’ CRMs and other systems. All updates occur in real-time. All of the data on all the reviewed and closed loans, lender engagement, and all the history of the deals can be analyzed.

We are in the relationship-driven industry and commercial mortgage brokers and lenders have to deal with potentially hundreds of customer touchpoints. Those customers expect the best technology-based customer service from everyone, from smaller independent mortgage brokers, to larger companies like CBRE and JLL; and from a debt fund to a large national bank like JP Morgan Chase. Just like the 200 software companies in other industries, RealAtom is pledging to build the new standard for commercial real estate lending:

- A world of choice, where businesses in commercial real estate lending are free to build a technology stack with the tools that they need, not just the one that their CRM suite has chosen for them.

- A world of flexibility, where data can be used across every department to exceed customer expectations, not just in sales and marketing.

- A world of opportunity, where every business can have the technology and ability to be customer-first.

It’s the first quarter of 2020 and a new decade has just started. We, together with other independents, are taking the lead to a new world for business. We have the ideas, and we are taking action.

;)