Commercial real estate investors, operators, brokers, and lenders have spent the last 2 months changing their day-to-day work processes, learning to conduct their operations remotely, adjusting to the increased risks related to the market conditions, and adapting their business strategies accordingly. On top of that, securing commercial debt has become challenging for several reasons: many lending institutions have frozen their CRE lending activity, some have redirected their personnel towards PPP SBA loan applications and those that are lending have changed their risk profile due to the uncertainty of COVID-19 pandemic.

Making sense of what to do next in the situation of ever-changing markets is challenging enough, but when you have a CRE property in need of debt financing, finding a right lender either within or outside of your existing relationships, can be a matter of survival. To succeed in this challenging endeavor and close your loan before the deadline, two factors must be true. First, an efficient way to work with your existing lenders. If you see your existing relationship lenders sitting on the sidelines waiting for the markets to stabilize, you need a second option, access to an extended network of lenders.

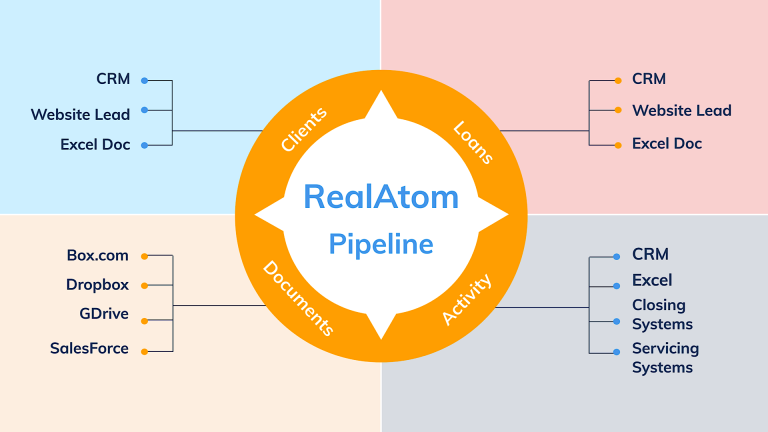

This is why, in order to provide relief to industry professionals during these challenging times, RealAtom is now offering borrowers and mortgage brokers FREE access to the platform through August 31, 2020. The offer includes loan request workflow efficiency, access to our vast network of lenders in a marketplace setting, and full transparency into the lender activity and engagement. Sign up for the free program here or read below for more about how borrowers and brokers are working through the platform today, tools you can use, and how RealAtom can help.

Loan Application efficiency

Whether you work with 3, 20, or 200 lenders, you want to know where any one of those lenders is in the process, keep track of the information you have already shared with each lender, and what information they have requested. Organizing your loan applications through RealAtom is an easy and intuitive process. It takes minutes. The loan request module will adjust to your loan type, property type, and purpose and ask you the questions typically asked by the lenders. It is up to you how much detail you want to include in your digital application. Supplement the loan request with additional information by attaching documents. Share it with your existing lenders through a pre-generated email that will deliver a beautiful loan summary. Don’t worry, there are security controls to keep your documents private and require lenders to sign confidentiality agreements. And when lenders need more details they can request additional documents or simply ask a question. All of that will be reflected in your Lender Management dashboard on RealAtom.

Learn what you need in order to create a loan request here.

Lender Network

Joining the platform will allow you to not only work with your existing lending relationships but also get exposure to our growing network of lenders. This network consists of national, regional, community banks, life insurance companies, debt funds, hard money lenders and other private lenders. These lenders come to RealAtom because they are looking to grow their book of business and get exposure to quality transactions. We are seeing substantial demand for loans from $1 million to $50 and $70+ million. Right now it’s more important than ever to have access to a wide variety of lending products and the RealAtom lender network delivers! And if that was not great already, any lender that submits a quote on your loan will be automatically added to your database of lenders. This way you can continue to grow your business.

Learn how to share loan requests & documents with lenders.

Quotes, Negotiations, Term Sheets

What would you do if you were able to save at least 6 hours per week? Would you work on more loan requests? Or would you spend that time on family and leisure? You don’t have to answer this question. Just know that RealAtom technology helps you get to the funding decision faster. Once you share your loan with the lenders, those interested, start engaging with you through the platform asking questions, requesting documents, and submitting their soft quotes. The “Aha” moment is seeing that soon after you share your loan request you get to download the quote matrix and compare the lender offers side by side with one single click. Dive in to analyze and give lenders a call to discuss. Alternatively, save yourself some time and accept the quote or negotiate it right from your dashboard. The bottom line is that whatever is submitted through the platform automatically creates a track record of information exchange during your loan application for both, you and for your lenders. Can you do that when sending emails???

Tips and tricks for quotes, questions, and document requests.

Deal Room

The built-in deal room is automatically activated for the transaction when there is a signed term sheet. Whether your transaction is in underwriting or already going for closing, document collection will be streamlined and organized. Your lender will create a checklist (or several) for the documents they need to collect. Each document will have an assigned due date. The important thing is that the information exchange is instant. Once a lender creates a checklist, it instantly appears in the deal dashboard on your side of the platform. When you submit a document, you know it is in the right folder, under the right checklist, in the right deal, on the lender’s side of the platform. When you submit the documents, your lender will review each document and if it satisfies their requirements they will accept it. In the event that they do not accept the document, they will provide a reason for you, and you will know where to find that comment. No more searching through emails! On top of that, always stay on track. Deal room statistics and closing dates will keep you up to date on where you are in the closing process.

Read about the deal room and lender checklists here.

Lender Management

Transparency is at the heart of our company culture and is a focal point of our product. We give you full visibility into your lender’s activity and engagement on every single loan transaction. Our lender management module lets you review how your request is performing among the lenders you have chosen to share it with and assess their level of interest and commitment. Get insight into who opened your loan marketing email, saw the preview of your loan, viewed the entire package, signed a confidentiality agreement, downloaded or viewed the attached documents, submitted soft quotes, and term sheets.

Become a pro at lender management.

Whether you are refinancing an existing property or acquiring a new one we hope RealAtom will be able to make your life easier in these times of crisis. Let us know if you need help with setup. We will continue doing what we can to help.

Make sure you sign up for the free program to learn more about how it all works and how you can benefit from RealAtom.

;)